In the age of the internet, shops are closing down. Traditional sales models are gradually disintegrating. One wouldn't think so, but the internet is also disrupting the art market trade. Like any other business, the art market is rapidly shifting to an "art + internet + finance" online model. The internet is leading the art market towards new horizons.

Art Fairs Have a Major Role in the Primary Market

The internationally renowned Art Basel and Frieze Art Fairs, as well as the newly-launched ART021 and West Bund in China, are becoming increasingly influential in the art trade. According to Arteron, each year, there are approximately 270 art fairs in the world. Galleries make about 40% to 60% of their annual sales income on those occasions, which explains why art dealers are so keen to devote their energy to those events.

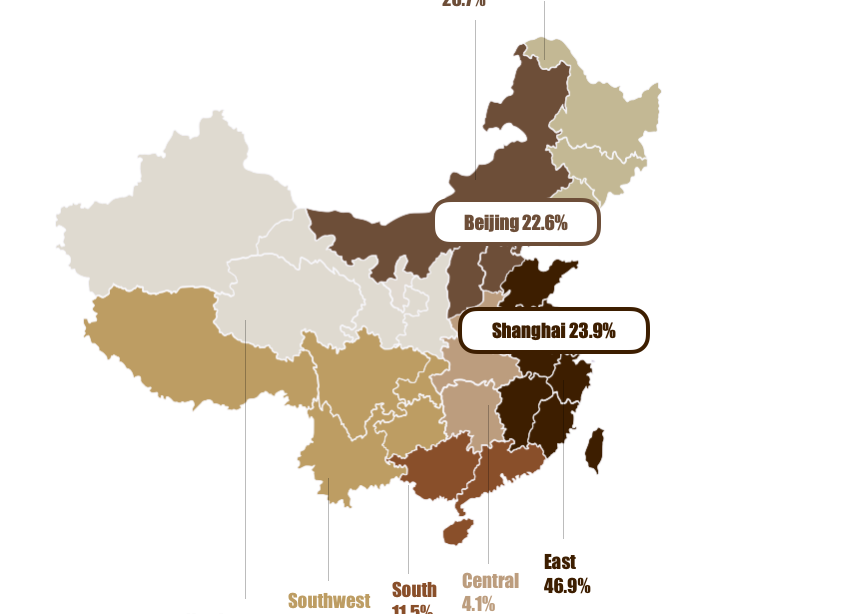

China's art fairs have greatly improved in the recent years. The early generation art fairs, such as Shanghai Art and Art Beijing, mainly featured local and regional galleries. Nowadays, they attract international galleries, fashionistas, and academics from all over the world. Shanghai's ART021 and West Bund, have given China's gallery industry a new breath of life. Artists and art experts are setting up new exhibition platforms throughout the country. In 2017, the galleries in Beijing launched the "Beijing Gallery Weekend" in an attempt to enter the primary art market.

▲ ART021 at Shanghai Exhibtion Centre

According to Chen Haitao, Director of the China Contemporary Art Institute, "Galleries hold five to six exhibitions a year, they participate in a similar amount of art fairs, and their sales ratio is also about the same. Art fairs have become an important source of revenue for galleries."

Many art dealers also believe that art fairs and other similar events, are the most competitive platforms for the primary and secondary markets. In 2017, an annual report by the European Fine Art Foundation pointed out that for some art dealers, art fairs have become a vital source of income. Maastricht TEFAF exhibitor, Lisson, believes that globalization is the reason behind the increase in art fairs, "Nowadays, transportation and information are very accessible, people travel around the world to get what they want, which requires art dealers to do likewise. As we get to know our customers, we must also look for artworks. Some international art fairs are already gathering all the global resources together. Even if they are regional art fairs, they still play a role in putting together the resources. You always meet new customers or fetch new information at art fairs. "

Aside from being a great source of information for both art lovers and galleries, art fairs are also great for advertisements and promotions. TEFAF exhibitor, Floris J. Van Der Ven, said in an interview, "I think that as art dealers, our main task is to instil the idea of art collection in our potential clients. Alone, the art dealer cannot do much, but together we can make a difference. For example, advertising at TEFAF is nothing like doing it in your own store. Not only art lovers but also medias from all over the world come here!"

Recently, a survey on primary markets showed that a large number of galleries and stores have been closed due to the increase of art fairs. These days, art dealers find it costly to run a gallery or a store because of high maintenance costs, unstable supply sources, and limited visibility. In the end, the results are not as good as participating in a few major art events every year.

On the other hand, the excellent results at art fairs have given galleries more confidence, with some even presenting artists' solo art projects on those occasions. For instance, the ShanghART Gallery held a DiaoDeqian solo exhibition at the West Bund Art Fair in Shanghai. The Hive Centre for Contemporary Art launched Liang Quan's solo exhibition at the 2017 Hong Kong Art Basel. According to the Hive Centre Director, Xia Jifeng, "Honestly speaking, to introduce a solo exhibition at an art fair is a risky move, because if the artist's work is not well received, there is nothing else to showcase. But fortunately the overall response turned out to be overwhelming."

Popularization: Art E-Commerce 2.0

In the past decade, e-commerce has gradually settled in the art market. In 2013, financial agencies and traditional art institutions, both began to invest massively into art e-commerce. The latest technology breakthroughs have allowed new business models to grow and adapt to the market's need. Interactions between humans and machines have continuously developed ever since the first generation e-commerce business model. The new intrinsic relation between the internet and art has disrupted the art trade. Traditional galleries need to adapt to the new online business model if they want to survive.

However, this new model is already showing cracks. Many Chinese art e-commerce businesses don't know how to position themselves on the market due to a homogeneous competition, high costs and low sales. The profitable golden age of e-commerce is long gone. Hence, if a business model is too rigid, it becomes even harder and costly for a company to keep up. In order to stay competitive, companies must remain flexible, and be able to foresee the future of the industry.

In 2015, Etsy rang the bell at Nasdaq and became the first art e-commerce listed company on the stock exchange. The 2018 Hiscox Online Trade Report revealed that online art sales totalled $4.22bn, with an annual increase of 12%. If the numbers continue to grow at this rate, online market sales will reach $9bn by 2020. From the market's point of view, it appears that online trading is becoming a major trend in the global art trade.

As for now, e-commerce seems to have cast a shadow over the traditional model of art trade. Some galleries only have online stores, while others have both traditional and online businesses. Auction houses such as Christie's and Sotheby's have also been pressured to open online auctions. Furthermore, there are countless intermediary agencies selling artworks, holding art fairs, and handling online auctions.

▲The only complete archive of Supreme skate decks in a Sotheby’s online-only auction

According to the 2017 TEFAF Art Market Report, approximately 8% of art auction sales took place online. For art dealers, 4% of their global sales of $26bn occurred online. Even though the market for online sale was relatively small, the online revenue growth is at nearly 19% according to a Maastricht University global dealer survey.

In regard to art trade, e-commerce is more than a business platform. It is a channel for anyone who wants to enter the art world. There are many people interested in collecting artworks. Some of them have great investment assets, but no time to travel around the world to purchase art.

High-End Services: Private Transactions

In 2016, American talk show host Oprah Winfrey, sold from her private collection Gustav Klimt's Portrait of Adele Bloch-Bauer II, at $150m to a mysterious Chinese buyer. The sale was handled privately by the famous art dealer Larry Gagosian.

The most obvious benefit of private sales is that they are not affected by the highs and lows of the auction market. This is also a reason why auction houses decided to open their business to private trade. In 2010, 10% of Sotheby's annual sales came from private transactions. Christie's private sales started in 2005, and its sales ratio increased rapidly to reach $700m in 2015.

He Xingqi, Director of Christie's Impressionist and Contemporary Art Department in Asia, explained the difference between auctions, private sales, and private exhibitions, "Auctions are product-oriented. You have to solicit auction items and then try to sell them. Private sales are customer-oriented. First you have to understand the customer's needs and then select suitable items for them. Private exhibitions are new phenomenon that aim at business development."

Accurate targeting, high confidentiality, no time restriction and room for bargaining, are among the private sales advantages that attract collectors.

Art consultants advise collectors on investment decisions, auction bidding, and purchase negotiations. They can also refer their clients to qualified experts if deemed necessary. In return, they receive a commission (usually 10% of the price), or earn monthly/annual consulting fees.

Adam Lindeman, a collector and art dealer, explained to the BBC, "Art consulting services have become the hub of the industry. You (the collectors) purchase not only art, but also your art consultant's advice." Art consultants share with collectors their professional knowledge and expertise to help them tell apart masterpieces from mediocre pieces, predict art market trends, and foresee the not yet appreciated artists.

Senior art consultants are important in ushering new collectors into the art world. Indeed, it can prove difficult to buy art even if one has the financial means. The most prominent galleries only sell to their most respected and loyal customers. Hence, without the help of an experienced art advisor, new buyers can't buy from the most prestigious galleries.

Investment: Art Finance

On the international capital market, artworks are among the three major investments projects. The return rate of artworks exceeds by far stocks and real estate, making it the current most sought after added value for investors.

In comparison with financial securities and real estate, the return rate on art market investments is more advantageous for investors. According to Wall Street Journal, art is among the best investment of 2018. The investment into art turned out to an average gain of 10.6% by the end of November, according to Art Market Research’s Art 100 Index. While, investment in the S&P 500 have lost 5.1% and gold holders have lost 2.2%.

▲Dr Rachel Pownall presents the Tefaf art market report in March 2017

The TEFAF 2017 Art Market Report released by the European Fine Art Foundation, shows that although the 2016 global economy was shaky, the art market remained both steady and prosper. In 2016, the value of global art sales amounted to $45bn, rising up to nearly 1.7% in comparison with 2015.

Investment in artworks have gone from being personal hobbies to becoming new kinds of wealth management. Whether it is in the form of mortgages, trusts or funds, capital is invested massively into arts these days.

However, three major issues still need to be addressed: authentication, assessment and mobility. Among them, authentication is the most important. Counterfeits and fake auctions are still harming the art market. The average annual sales of counterfeit art in the recent years reached as high as $6bn. There are often disputes over the authenticity and origin of artworks, as well as troubles with nonpayment issues. This is why professionals are looking towards blockchain technology to gain back trust and security for future online art trades.