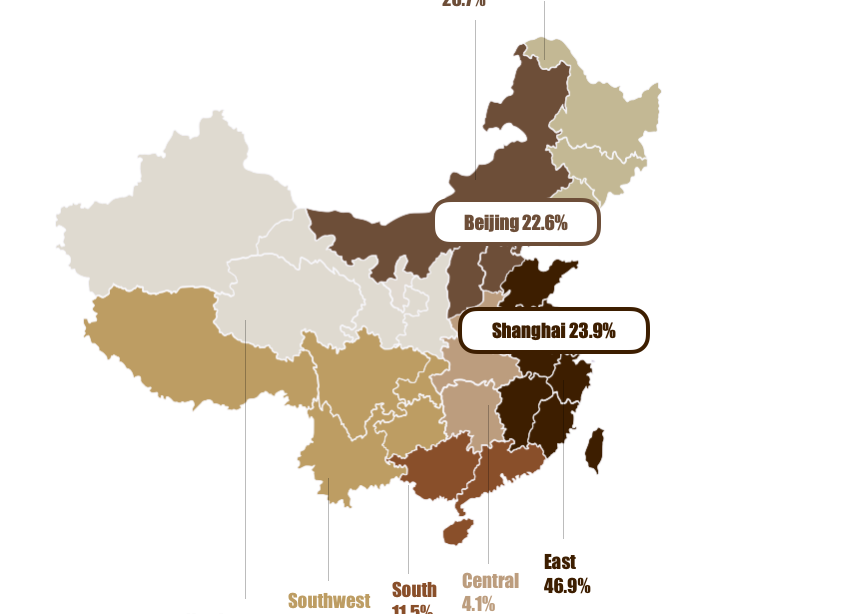

The latest Art Market Report by UBS showed a somewhat distressed Chinese art market to the world. Even though China still ranks the third biggest art market in the world, valued at $12.9bn and accounting for 19% of the world market in 2018, the sales in the mainland's auction sector fell by 6% over the year and were even 24% down at Poly Auction. In Hong Kong, auction sales were down 22% as well.

Moreover, a decline in the number of highly-priced lots sold also contributed to this report. The top segment decreased in value by 36%; lots sold for more than 100m yuan ($16m) were 20% fewer than in 2017.

We see "a contraction in the supply of high-quality works and cautious buying, as trade and debt crises loomed" of the Chinese art market in 2018. And this is closely linked with the unhealthy collectors' structure in China. On one hand, many Chinese collectors, which are more likely "investors," started quitting the market in the last 8 years. On the other hand, the collectors that remain in the market are basically fixed. Seldom do new collectors enter the market.

From 2008 through 2011, the Chinese art market saw exceptional growth in sales in the sector in mainland China with aggregate values increasing by over 500%. In 2011, China surpassed the US, becoming the world's largest art market. Kou Qin, CEO of China Guardian Auction House, commented: "Before 2012, the Chinese art market was like a 'horse without reins'. The market supply exceeded demand. We see the prices of some artworks were way higher than their actual value. Many people who did not have any experience of art collecting or enough capitals were also buying and selling art frequently in the market."

▲ China Guardian 2011 Autumn Auction

During the heyday, art investment funds were extremely popular. According to the Art & Finance Report 2011 by Deloitte and ArtTactic, the art fund and art investment market in China reached over $320m in 2011, with $182m new investment raised in the first half of the year and another $330m in the pipeline. However, prosperity doesn't last long.

In December 2014, an art fund project called "Mo Yun No.1," established by CITIC Trust in 2011, failed to pay its investors on time. The art fund project originally collected 31m yuan (about $4m) from 17 commissioners to invest in traditional as well as contemporary Chinese art. The estimated annualized rate of return was more than 6%. However, few of the investors got back 10% of their principles at maturity. This was not the only overdue payment case of art funds and investment projects in China. In 2012, fake mortgaged artworks were found in another art fund project launched in Beijing, which was worth 870m yuan (about $129m).

The failure of those art investment projects was largely due to the investors, as they were all from financial backgrounds rather than art-collecting ones. They neglected the fact that art is a long-term investment which requires a careful operation—they only invested in them as other "purer" financial investments.

▲ Asia Institute of Art & Finance Summit is now in its third year. The summit is most about how to invest in art

Because of all the losses they had in the art market, the capitals that were not true art enthusiasts began to weed out within the last 8 years. Wu Kejia, author of the 2019 Tefaf Art Market Report, told us: "From our investigation, we saw that there were many capitals that were not really into art got into the market around 2011. However, in the past 8 years, these capitals weeded out. In the next 5 to 10 years, the second-tier of the Chinese art market will remain the same as in 2011."

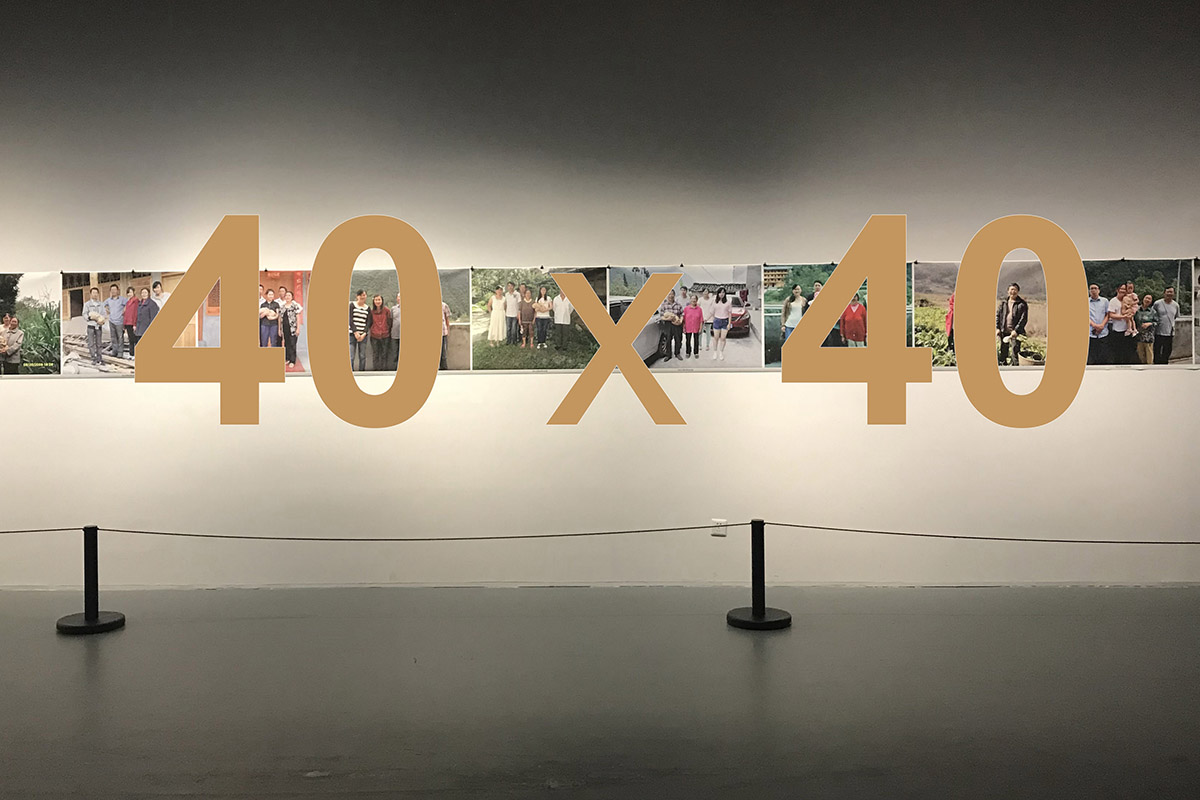

What is left in the market are the real art collectors, yet the group is still relatively small. According to Tefaf Art Market Report 2019, the number of collectors before 1978 was very low. Art collecting was not encouraged at that time as buying or selling art privately was extremely difficult. Art collecting didn't come into the mainstream until the 1990s when the first auction house, China Guardian, was built. It is obviously impossible to cultivate a big and systematic collectors' group in merely 20 years. Wang Yifei, executive director of Art Gallery Beijing, said: "The current situation of the Chinese scene now is that we don't see any growth in the number of art collectors, especially the number of contemporary art collectors."

Certainly, it is bad news that there is no growth in the number of art collectors in China. However, what makes the situation worse is that most collectors are cautiously buyers now. They no longer randomly shell out cash for artwork priced in the millions. Instead, they will do detailed assessments before purchasing. The founder of Tang Contemporary Art said in a previous interview: "A few years ago (in 2011), we still saw collectors paying 40 or 50m yuan for an artwork. However, stories like those are rarely heard nowadays. "

▲ 798 art district in Beijing

The truth is that Chinese collectors always have money. It is only that they do not know what art to buy in the market. Wang Yifei explained: "Art collectors in China seeks a sense of security when they are buying art."

However, this is not necessarily a bad sign. The cautiousness of the buyers indicates a more mature and healthier market in China. Felix Kwok, deputy director, Asia, said: "We think the market doesn't lack capital. What they need is a reason to buy. Our collectors are more mature these days. They already know they should not just follow the trend. They understand art collecting is a long-term investment and has its own core value. They'd rather spend more money on high-quality products."

Therefore, we need to be more confident with the Chinese art market. What we will see in the future is a more healthily growing market.